Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 55

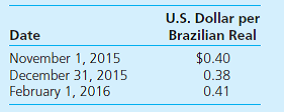

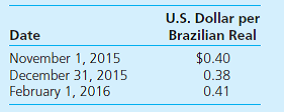

On November 1, 2015, Dos Santos Company forecasts the purchase of raw materials from a Brazilian supplier on February 1, 2016, at a price of 200,000 Brazilian reals. On November 1, 2015, Dos Santos pays $1,500 for a three-month call option on 200,000 reals with a strike price of $0.40 per real. Dos Santos properly designates the option as a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2015, the option has a fair value of $1,100. The following spot exchange rates apply:

What is the net impact on Dos Santos Company's 2016 net income as a result of this hedge of a forecasted foreign currency transaction Assume that the raw materials are consumed and become a part of the cost of goods sold in 2016.

A) $80,000 decrease in net income.

B) $80,600 decrease in net income.

C) $81,100 decrease in net income.

D) $83,100 decrease in net income.

What is the net impact on Dos Santos Company's 2016 net income as a result of this hedge of a forecasted foreign currency transaction Assume that the raw materials are consumed and become a part of the cost of goods sold in 2016.

A) $80,000 decrease in net income.

B) $80,600 decrease in net income.

C) $81,100 decrease in net income.

D) $83,100 decrease in net income.

التوضيح

Explanation:

Calculate the AOCI.

...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255