Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 63

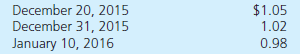

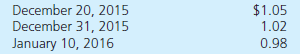

On December 20, 2015, Butanta Company (a U.S. company headquartered in Miami, Florida) sold parts to a foreign customer at a price of 50,000 ostras. Payment is received on January 10, 2016. Currency exchange rates for 1 ostra are as follows:

a. How does the fluctuation in exchange rates affect Butanta's 2015 income statement

b. How does the fluctuation in exchange rates affect Butanta's 2016 income statement

a. How does the fluctuation in exchange rates affect Butanta's 2015 income statement

b. How does the fluctuation in exchange rates affect Butanta's 2016 income statement

التوضيح

a)

Sutana Company sold goods to foreign...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255