Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 44

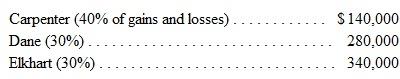

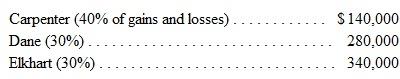

A partnership has the following capital balances:

Krystal is going to pay a total of $240,000 directly to these three partners to acquire a 25 percent ownership interest from each. Goodwill is to be recorded. What is Dane's capital balance after the transaction

A) $210,000.

B) $255,000.

C) $340,000.

D) $352,000.

Krystal is going to pay a total of $240,000 directly to these three partners to acquire a 25 percent ownership interest from each. Goodwill is to be recorded. What is Dane's capital balance after the transaction

A) $210,000.

B) $255,000.

C) $340,000.

D) $352,000.

التوضيح

Therefore, the correct answe...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255