Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 21

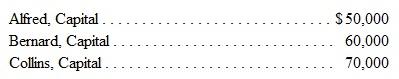

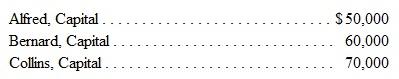

A partnership begins its first year with the following capital balances:

The articles of partnership stipulate that profits and losses be assigned in the following manner:

• Each partner is allocated interest equal to 5 percent of the beginning capital balance.

• Bernard is allocated compensation of $18,000 per year.

• Any remaining profits and losses are allocated on a 3:3:4 basis, respectively.

• Each partner is allowed to withdraw up to $5,000 cash per year.

Assuming that the net income is $60,000 and that each partner withdraws the maximum amount allowed, what is the balance in Collins capital account at the end of that year

A) $70,800.

B) $86,700.

C) $73,500.

D) $81,700

The articles of partnership stipulate that profits and losses be assigned in the following manner:

• Each partner is allocated interest equal to 5 percent of the beginning capital balance.

• Bernard is allocated compensation of $18,000 per year.

• Any remaining profits and losses are allocated on a 3:3:4 basis, respectively.

• Each partner is allowed to withdraw up to $5,000 cash per year.

Assuming that the net income is $60,000 and that each partner withdraws the maximum amount allowed, what is the balance in Collins capital account at the end of that year

A) $70,800.

B) $86,700.

C) $73,500.

D) $81,700

التوضيح

Therefore, the correct answe...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255