Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 1

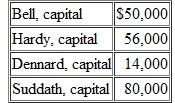

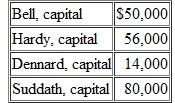

A local partnership is considering possible liquidation because one of the partners (Bell) is insolvent. Capital balances at the current time are as follows. Profits and losses are divided on a 4:3:2:1 basis, respectively.

Bell's creditors have filed a $21,000 claim against the partnership's assets. The partnership currently holds assets reported at $300,000 and liabilities of $100,000. If the assets can be sold for $190,000, what is the minimum amount that Bell's creditors would receive

A) -0 -

B) $2,000.

C) $2,800.

D) $6,000.

Bell's creditors have filed a $21,000 claim against the partnership's assets. The partnership currently holds assets reported at $300,000 and liabilities of $100,000. If the assets can be sold for $190,000, what is the minimum amount that Bell's creditors would receive

A) -0 -

B) $2,000.

C) $2,800.

D) $6,000.

التوضيح

Partnership accounting is a type of busi...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255