Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 9

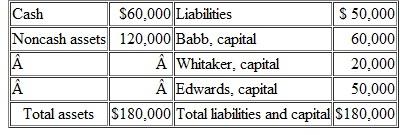

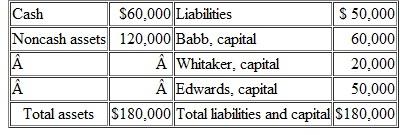

A partnership's balance sheet is as follows:

Babb, Whitaker, and Edwards share profits and losses in the ratio of 4:2:4, respectively. This business is to be terminated, and the partners estimate that $8,000 in liquidation expenses will be incurred. How should the $2,000 in safe cash that is presently held be disbursed

Babb, Whitaker, and Edwards share profits and losses in the ratio of 4:2:4, respectively. This business is to be terminated, and the partners estimate that $8,000 in liquidation expenses will be incurred. How should the $2,000 in safe cash that is presently held be disbursed

التوضيح

Maximum Potential Losses and Safe Cash B...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255