Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372 تمرين 81

From Recording Transactions (Including Adjusting Journal Entries) to Preparing Financial Statements and Closing Journal Entries (Chapters 2,3, and 4)

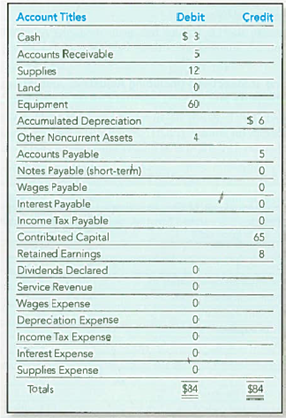

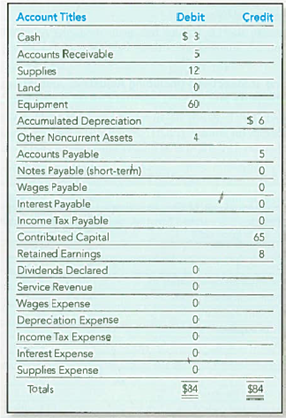

Brothers Harry and Herman Hausyerday began operations of their machine shop (H H Tool, Inc.) on January 1, 2010. The annual reporting period ends December 31. The trial balance on January 1, 2012, follows (the amounts are rounded to thousands of dollars to simplify):

Transactions during 2012 (summarized in thousands of dollars) follow:

a. Borrowed $12 cash on a six-month note payable dated March 1, 2012.

b. Purchased land for future building site, paid cash, $9.

c. Earned revenues for 2012, $160, including $40 on credit and $120 collected in cash.

d. Issued additional shares of stock for $3.

e. Recognized wages expense for 2012, $85 paid in cash.

f. Collected accounts receivable, $24.

g. Purchased other noncurrent assets, $ 10 cash.

h. Paid accounts payable, $13.

i. Purchased supplies on account for future use, $18.

j. Signed a $25 service contract to start February 1, 2013.

k. Declared and paid a cash dividend, $17.

Data for adjusting journal entries:

l. Supplies counted on December 31, 2012, $10.

m. Depreciation for the year on the equipment, $6.

n. Accrued interest of $1 on notes payable.

o. Wages earned not yet paid or recorded, $12.

p. Income tax for the year was $8. It will be paid in 2013.

Required:

1. Set up T-accounts for the accounts on the trial balance and enter beginning balances.

2. Record journal entries for transactions ( a ) through ( k ), and post them to the T-accounts.

3. Prepare an unadjusted trial balance.

4. Record and post the adjusting journal entries ( l ) through ( p ).

5. Prepare an adjusted trial balance.

6. Prepare an income statement, statement of retained earnings, and balance sheet.

7. Prepare and post the closing journal entries.

8. Prepare a post-closing trial balance.

9. How much net income did H H Toot, Inc., generate during 2012 What was its net profit margin Is the company financed primarily by liabilities or stockholders' equity What is its current ratio

Brothers Harry and Herman Hausyerday began operations of their machine shop (H H Tool, Inc.) on January 1, 2010. The annual reporting period ends December 31. The trial balance on January 1, 2012, follows (the amounts are rounded to thousands of dollars to simplify):

Transactions during 2012 (summarized in thousands of dollars) follow:

a. Borrowed $12 cash on a six-month note payable dated March 1, 2012.

b. Purchased land for future building site, paid cash, $9.

c. Earned revenues for 2012, $160, including $40 on credit and $120 collected in cash.

d. Issued additional shares of stock for $3.

e. Recognized wages expense for 2012, $85 paid in cash.

f. Collected accounts receivable, $24.

g. Purchased other noncurrent assets, $ 10 cash.

h. Paid accounts payable, $13.

i. Purchased supplies on account for future use, $18.

j. Signed a $25 service contract to start February 1, 2013.

k. Declared and paid a cash dividend, $17.

Data for adjusting journal entries:

l. Supplies counted on December 31, 2012, $10.

m. Depreciation for the year on the equipment, $6.

n. Accrued interest of $1 on notes payable.

o. Wages earned not yet paid or recorded, $12.

p. Income tax for the year was $8. It will be paid in 2013.

Required:

1. Set up T-accounts for the accounts on the trial balance and enter beginning balances.

2. Record journal entries for transactions ( a ) through ( k ), and post them to the T-accounts.

3. Prepare an unadjusted trial balance.

4. Record and post the adjusting journal entries ( l ) through ( p ).

5. Prepare an adjusted trial balance.

6. Prepare an income statement, statement of retained earnings, and balance sheet.

7. Prepare and post the closing journal entries.

8. Prepare a post-closing trial balance.

9. How much net income did H H Toot, Inc., generate during 2012 What was its net profit margin Is the company financed primarily by liabilities or stockholders' equity What is its current ratio

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255