Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372 تمرين 40

Evaluating the Effects of Inventory Methods on Income from Operations, Income Taxes, and Net Income (Periodic)

Courtney Company uses a periodic inventory system. Data for 2012: beginning merchandise inventory (December 31, 2011), 1,000 units at $35; purchases, 4,000 units at $38; operating expenses (excluding income taxes), $91,500; ending inventory per physical count at December 31, 2012, 900 units; sales price per unit, $75; and average income tax rate, 30%.

Required:

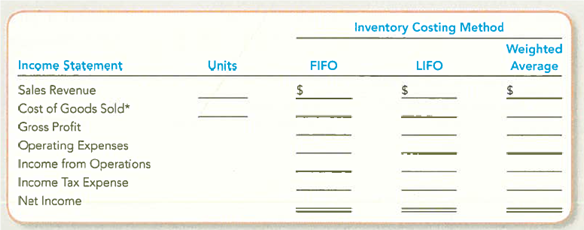

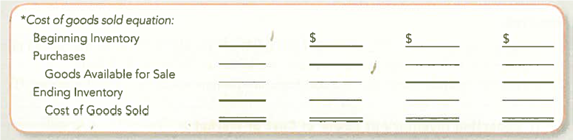

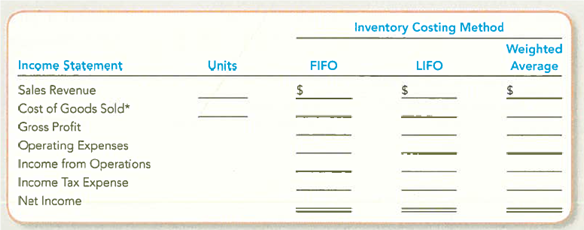

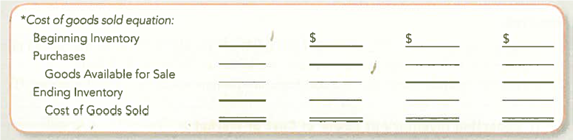

1. Prepare income statements under the FIFO, LIFO, and weighted average costing methods. Use a format similar to the following:

2. Between FIFO and LIFO, which method is preferable in terms of ( a ) maximizing income from operations or ( b ) minimizing income taxes Explain.

3. What would be your answer to requirement 2 if costs were falling Explain.

Courtney Company uses a periodic inventory system. Data for 2012: beginning merchandise inventory (December 31, 2011), 1,000 units at $35; purchases, 4,000 units at $38; operating expenses (excluding income taxes), $91,500; ending inventory per physical count at December 31, 2012, 900 units; sales price per unit, $75; and average income tax rate, 30%.

Required:

1. Prepare income statements under the FIFO, LIFO, and weighted average costing methods. Use a format similar to the following:

2. Between FIFO and LIFO, which method is preferable in terms of ( a ) maximizing income from operations or ( b ) minimizing income taxes Explain.

3. What would be your answer to requirement 2 if costs were falling Explain.

التوضيح

1.

Prepare the required income statemen...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255