Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372 تمرين 7

Recording and Interpreting the Disposal of Long-Lived Assets

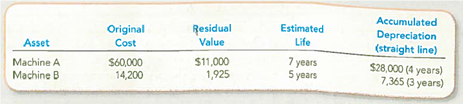

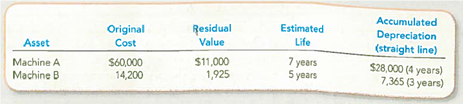

During 2013, Rayon Corporation disposed of two different assets. On January 1, 2011 their disposal, the accounts reflected the following:

The machines were disposed of in the following ways:

a. Machine A: Sold on January 2, 2013, for $33,500 cash.

b. Machine B: On January 2, 2013, this machine suffered irreparable damage from an accident and was removed immediately by a salvage company at no cost.

Required:

1. Give the journal entries related to the disposal of each machine at the beginning of 2013.

2. Explain the accounting rationale for the way that you recorded each disposal.

During 2013, Rayon Corporation disposed of two different assets. On January 1, 2011 their disposal, the accounts reflected the following:

The machines were disposed of in the following ways:

a. Machine A: Sold on January 2, 2013, for $33,500 cash.

b. Machine B: On January 2, 2013, this machine suffered irreparable damage from an accident and was removed immediately by a salvage company at no cost.

Required:

1. Give the journal entries related to the disposal of each machine at the beginning of 2013.

2. Explain the accounting rationale for the way that you recorded each disposal.

التوضيح

(1) Give the journal entries related to ...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255