Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372 تمرين 58

Computing Depreciation and Book Value for Two Years Using Alternative Depreciation Methods and Interpreting the Impact on the Fixed Asset Turnover Ratio

Tore Company bought a machine for $65,000 cash. The estimated useful life was five years, and the estimated residual value was $5,000. Assume that the estimated useful life in productive units is 150,000. Units actually produced were 40,000 in year 1 and 45,000 in year 2.

Required:

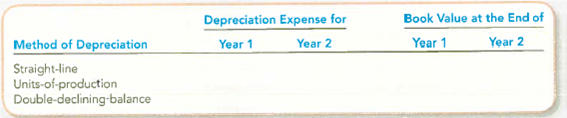

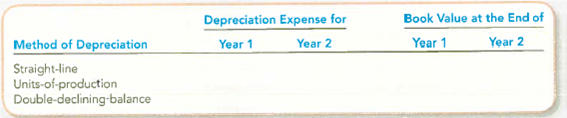

1. Determine the appropriate amounts to complete the following schedule. Show computations.

2. Which method would result in the lowest net income for year 1 For year 2

3. Which method would result in the lowest fixed asset turnover ratio for year 11 Why

Tore Company bought a machine for $65,000 cash. The estimated useful life was five years, and the estimated residual value was $5,000. Assume that the estimated useful life in productive units is 150,000. Units actually produced were 40,000 in year 1 and 45,000 in year 2.

Required:

1. Determine the appropriate amounts to complete the following schedule. Show computations.

2. Which method would result in the lowest net income for year 1 For year 2

3. Which method would result in the lowest fixed asset turnover ratio for year 11 Why

التوضيح

(1) Determine the appropriate amounts to...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255