Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

النسخة 4الرقم المعياري الدولي: 978-0078025372 تمرين 3

Interpreting Profitability, Liquidity, Solvency, and P/E Ratios

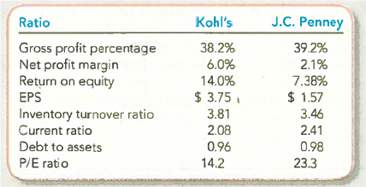

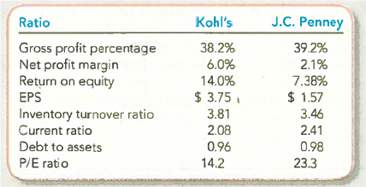

Kohl's Corporation is a national retail department store. The company's total revenues for the year ended January 29, 2010, were $18 billion. J.C. Penney is a similar size department store company with $18 billion of revenues. The following ratios for the two companies were obtained for that fiscal year from reuters.com/finance:

Required:

1. Which company appears more profitable Describe the ratio(s) that you used to reach this decision.

2. Which company appears more liquid Describe the ratio(s) that you used to reach this decision.

3. Which company appears more solvent Describe the ratio(s) that you used to reach this decision.

4. Are the conclusions from your analyses in requirements 1-3 consistent with the value of the two companies, as suggested by their P/E ratios If not, offer one explanation for any apparent inconsistency.

TIP: Remember that the stock price in the top of the P/E ratio represents investors' expectations about future financial performance whereas the bottom number reports past financial performance.

Kohl's Corporation is a national retail department store. The company's total revenues for the year ended January 29, 2010, were $18 billion. J.C. Penney is a similar size department store company with $18 billion of revenues. The following ratios for the two companies were obtained for that fiscal year from reuters.com/finance:

Required:

1. Which company appears more profitable Describe the ratio(s) that you used to reach this decision.

2. Which company appears more liquid Describe the ratio(s) that you used to reach this decision.

3. Which company appears more solvent Describe the ratio(s) that you used to reach this decision.

4. Are the conclusions from your analyses in requirements 1-3 consistent with the value of the two companies, as suggested by their P/E ratios If not, offer one explanation for any apparent inconsistency.

TIP: Remember that the stock price in the top of the P/E ratio represents investors' expectations about future financial performance whereas the bottom number reports past financial performance.

التوضيح

1.

Explanation:

• Although J. C. has a...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255