Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767 تمرين 8

Preparation of Income Statement: Manufacturing Firm

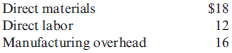

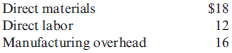

Laworld Inc. manufactures small camping tents. Last year, 200,000 tents were made and sold for $60 each. Each tent includes the following costs:

The only selling expenses were a commission of $2 per unit sold and advertising totaling $100,000. Administrative expenses, all fixed, equaled $300,000. There were no beginning or ending finished goods inventories. There were no beginning or ending work-in-process inventories.

Required:

1. Calculate the product cost for one tent. Calculate the total product cost for last year.

2. CONCEPTUAL CONNECTION Prepare an income statement for external users. Did you need to prepare a supporting statement of cost of goods manufactured Explain.

3. CONCEPTUAL CONNECTION Suppose 200,000 tents were produced (and 200,000 sold) but that the company had a beginning finished goods inventory of 10,000 tents produced in the prior year at $40 per unit. The company follows a first-in, first-out policy for its inventory (meaning that the units produced first are sold first for purposes of cost flow). What effect does this have on the income statement Show the new statement.

Laworld Inc. manufactures small camping tents. Last year, 200,000 tents were made and sold for $60 each. Each tent includes the following costs:

The only selling expenses were a commission of $2 per unit sold and advertising totaling $100,000. Administrative expenses, all fixed, equaled $300,000. There were no beginning or ending finished goods inventories. There were no beginning or ending work-in-process inventories.

Required:

1. Calculate the product cost for one tent. Calculate the total product cost for last year.

2. CONCEPTUAL CONNECTION Prepare an income statement for external users. Did you need to prepare a supporting statement of cost of goods manufactured Explain.

3. CONCEPTUAL CONNECTION Suppose 200,000 tents were produced (and 200,000 sold) but that the company had a beginning finished goods inventory of 10,000 tents produced in the prior year at $40 per unit. The company follows a first-in, first-out policy for its inventory (meaning that the units produced first are sold first for purposes of cost flow). What effect does this have on the income statement Show the new statement.

التوضيح

A product cost is the cost incurred in m...

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255