Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767 تمرين 4

Cash Budget

The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following:

a. Cash balance on June 1 is $736.

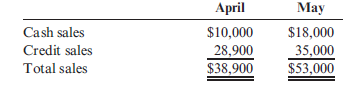

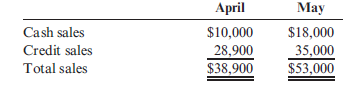

b. Actual sales for April and May are as follows:

c. Credit sales are collected over a three-month period: 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible.

d. Inventory purchases average 64% of a month's total sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month.

e. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner.

f. Rent is $4,100 per month.

g. Taxes to be paid in June are $6,780.

The owner also tells you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn't have access to short-term loans.

Required:

1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. (Round all amounts to the nearest dollar.)

2. CONCEPTUAL CONNECTION Did the business show a negative cash balance for June Suppose that the owner has no hope of establishing a line of credit for the business, what

recommendations would you give the owner for dealing with a negative cash balance

The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following:

a. Cash balance on June 1 is $736.

b. Actual sales for April and May are as follows:

c. Credit sales are collected over a three-month period: 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible.

d. Inventory purchases average 64% of a month's total sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month.

e. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner.

f. Rent is $4,100 per month.

g. Taxes to be paid in June are $6,780.

The owner also tells you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn't have access to short-term loans.

Required:

1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. (Round all amounts to the nearest dollar.)

2. CONCEPTUAL CONNECTION Did the business show a negative cash balance for June Suppose that the owner has no hope of establishing a line of credit for the business, what

recommendations would you give the owner for dealing with a negative cash balance

التوضيح

Cash Budget :

Cash budget is the excepte...

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255