Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767 تمرين 25

Residual Income

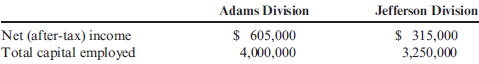

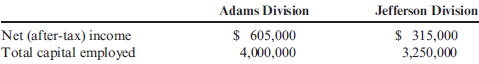

Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year's results:

Washington's actual cost of capital was 12%.

Refer to the information for Washington Company above. In addition, Washington Company's top management has set a minimum acceptable rate of return equal to 8%.

Required:

1. Calculate the residual income for the Adams Division.

2. Calculate the residual income for the Jefferson Division.

Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year's results:

Washington's actual cost of capital was 12%.

Refer to the information for Washington Company above. In addition, Washington Company's top management has set a minimum acceptable rate of return equal to 8%.

Required:

1. Calculate the residual income for the Adams Division.

2. Calculate the residual income for the Jefferson Division.

التوضيح

EVA (Economic value added) involves the ...

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255