Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

النسخة 4الرقم المعياري الدولي: 978-0324380767 تمرين 50

Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return

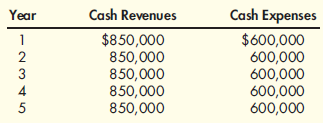

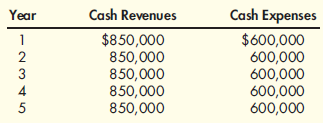

Craig Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $640,000. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Required:

1. Compute the payback period for the NC equipment.

2. Compute the NC equipment's ARR.

3. Compute the investment's NPV, assuming a required rate of return of 10 percent.

4. Compute the investment's IRR.

Craig Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $640,000. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Required:

1. Compute the payback period for the NC equipment.

2. Compute the NC equipment's ARR.

3. Compute the investment's NPV, assuming a required rate of return of 10 percent.

4. Compute the investment's IRR.

التوضيح

Techniques like NPV, ARR, IRR helps to e...

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255