Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 16

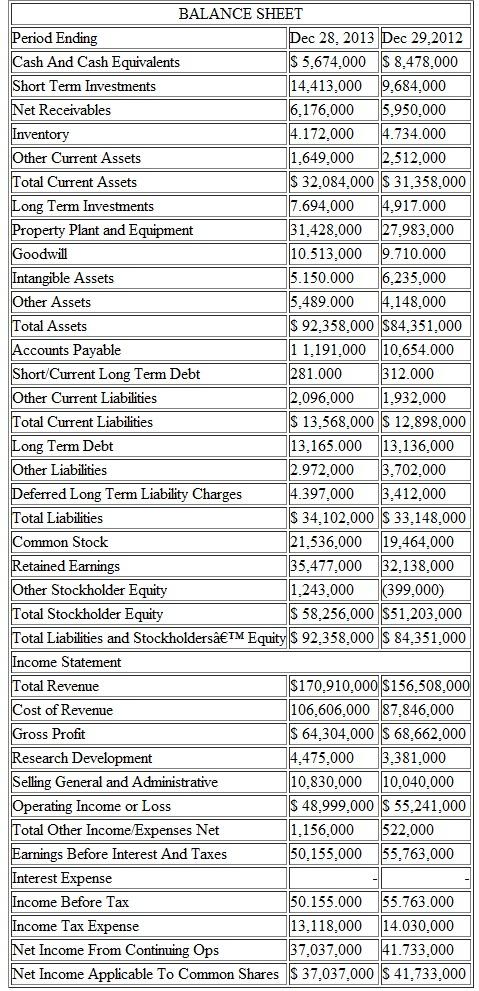

Table summarizes the financial conditions for Intel Corporation (INTC), a manufacturer of various computer-processing chips for fiscal year 2013. Compute the various financial ratios and interpret the firm's financial health during fiscal year 2013. The closing stock price was $25.50 on December 31, 2013 and the average number of outstanding shares was 4.98 billion.

(a) Debt ratio

(b) Times-interest-earned ratio

(c) Current ratio

(d) Quick (acid-test) ratio

(e) Inventory-turnover ratio

(f) Days-sales-outstanding

(g) Total-assets-turnover ratio

(h) Profit margin on sales

(i) Return on total assets (with a lax rate of 40%)

(j) Return on common equity

(k) Price/earnings ratio

(l) Book value per share

Table

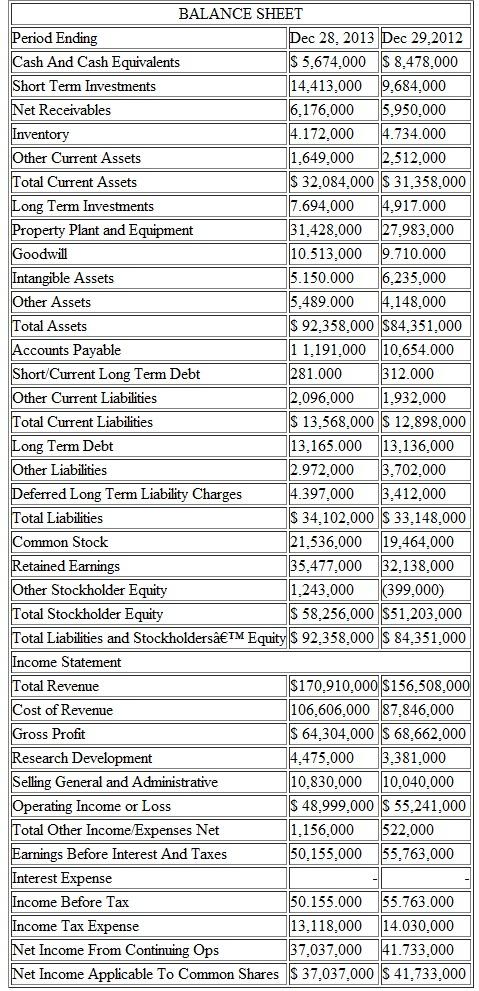

(a) Debt ratio

(b) Times-interest-earned ratio

(c) Current ratio

(d) Quick (acid-test) ratio

(e) Inventory-turnover ratio

(f) Days-sales-outstanding

(g) Total-assets-turnover ratio

(h) Profit margin on sales

(i) Return on total assets (with a lax rate of 40%)

(j) Return on common equity

(k) Price/earnings ratio

(l) Book value per share

Table

التوضيح

Debt Ratio: It depicts the relationship ...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255