Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 75

Suppose you are going to buy a home worth $110,000 and you make a down payment in the amount of $50,000. The balance will be borrowed from the Capital Savings and Loan Bank. The loan officer offers the following two financing plans for the property.

• Option 1. A conventional fixed-rate loan at an interest rate of 13% over 30 years with 360 equal monthly payments.

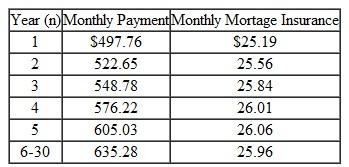

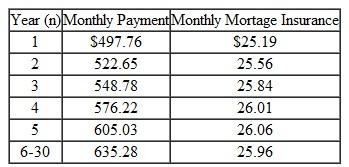

• Option 2. A graduated payment schedule at 11.5% interest with the monthly payment schedule given in Table 1. If you go with this graduated payment loan, mortgage insurance is a mustin addition to the monthly payments.

(a) Compute the monthly payment under option 1.

(b) What is the effective annual interest rate you are paying under option 2

(c) Compute the outstanding balance at the end of five years under each option.

(d) Compute the total interest payment under each option.

(e) Assuming that your only investment alternative is a savings account that earns an interest rate of 6% compounded monthly, which option is a better deal

Table 1

• Option 1. A conventional fixed-rate loan at an interest rate of 13% over 30 years with 360 equal monthly payments.

• Option 2. A graduated payment schedule at 11.5% interest with the monthly payment schedule given in Table 1. If you go with this graduated payment loan, mortgage insurance is a mustin addition to the monthly payments.

(a) Compute the monthly payment under option 1.

(b) What is the effective annual interest rate you are paying under option 2

(c) Compute the outstanding balance at the end of five years under each option.

(d) Compute the total interest payment under each option.

(e) Assuming that your only investment alternative is a savings account that earns an interest rate of 6% compounded monthly, which option is a better deal

Table 1

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255