Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 31

A utility company is in the process of considering two alternative methods of providing transformer capacity.

• Option 1: Purchase a 16 MVA transformer now and add a similar-sized unit at a later date when load growth is warranted. The price of a 16 MVA unit is $680,000.

• Option 2: Purchase a 25 MVA transformer at the outset which will meet the future load growth for at least the next 10 years. The price of a 25 MVA unit is $920,000.

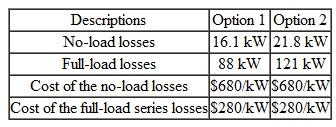

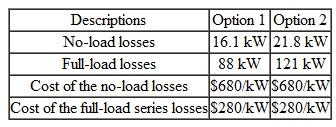

Technical specs for the transformers are as given in Table.

TABLE 2

Suppose the expected load growth over the next 20 years is 11 MVA during the first year and 1 MVA each following year over the previous year. Each transformer has a useful life of 20 years. Which transformer unit would be selected using an interest rate of 8% with the study period of 10 years How about with 20 years Assume the future replacement cost would be the same as the intial purchase price.

Suppose the expected load growth over the next 20 years is 11 MVA during the first year and 1 MVA each following year over the previous year. Each transformer has a useful life of 20 years. Which transformer unit would be selected using an interest rate of 8% with the study period of 10 years How about with 20 years Assume the future replacement cost would be the same as the intial purchase price.

• Option 1: Purchase a 16 MVA transformer now and add a similar-sized unit at a later date when load growth is warranted. The price of a 16 MVA unit is $680,000.

• Option 2: Purchase a 25 MVA transformer at the outset which will meet the future load growth for at least the next 10 years. The price of a 25 MVA unit is $920,000.

Technical specs for the transformers are as given in Table.

TABLE 2

Suppose the expected load growth over the next 20 years is 11 MVA during the first year and 1 MVA each following year over the previous year. Each transformer has a useful life of 20 years. Which transformer unit would be selected using an interest rate of 8% with the study period of 10 years How about with 20 years Assume the future replacement cost would be the same as the intial purchase price.

Suppose the expected load growth over the next 20 years is 11 MVA during the first year and 1 MVA each following year over the previous year. Each transformer has a useful life of 20 years. Which transformer unit would be selected using an interest rate of 8% with the study period of 10 years How about with 20 years Assume the future replacement cost would be the same as the intial purchase price.التوضيح

The fifth chapter of the textbook focuse...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255