Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 54

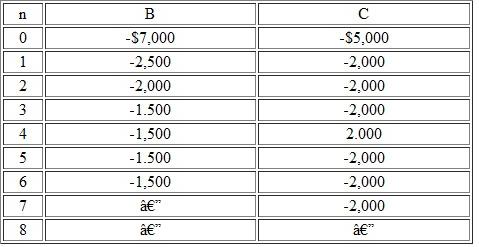

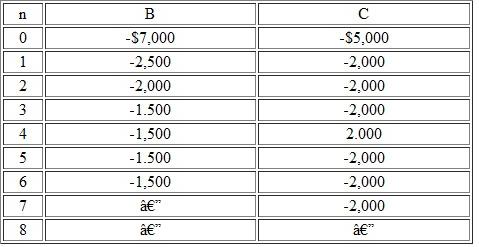

Consider each of the after-tax cash flows shown in Table 1.

Suppose that projects B and C are mutually exclusive. Suppose also that the required service period is eight years and that the company is considering leasing comparable equipment with an annual lease expense of $3,000, payable at the end of each year for the remaining years of the required service period. Which project is a better choice at 15%

Table 1

Suppose that projects B and C are mutually exclusive. Suppose also that the required service period is eight years and that the company is considering leasing comparable equipment with an annual lease expense of $3,000, payable at the end of each year for the remaining years of the required service period. Which project is a better choice at 15%

Table 1

التوضيح

Net present worth

The NPW (net present ...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255