Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 52

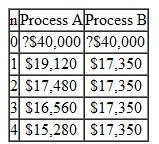

The cash flows in Table 1 represent the potential annual savings associated with two different types of production processes, each of which requires an investment of $40,000.

Table 1

Assume an interest rate of 12%.

Assume an interest rate of 12%.

(a) Determine the equivalent annual savings for each process.

(b) Determine the hourly savings for each process if it will be in operation of 3,000 hours per year.

(c) Which process should be selected

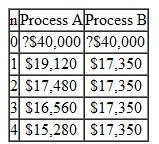

Table 1

Assume an interest rate of 12%.

Assume an interest rate of 12%.(a) Determine the equivalent annual savings for each process.

(b) Determine the hourly savings for each process if it will be in operation of 3,000 hours per year.

(c) Which process should be selected

التوضيح

The annual equivalent worth is a criteri...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255