Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 26

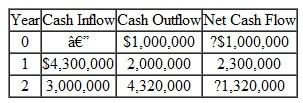

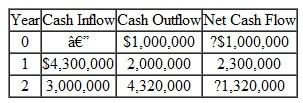

By outbidding its competitors, Trane Image Processing (TIP), a defense contractor, received a contract worth $7,300,000 to build navy flight simulators for U.S. Navy pilot training over two years. With some defense contracts, the U.S. government makes an advance payment when the contract is signed, but in this case, the government will make two progressive payments: $4,300,000 at the end of the first year and the $3,000,000 balance at the end of the second year. The expected cash outflows required to produce the simulators are estimated to be $1,000,000 now, $2,000,000 during the first year, and $4,320,000 during the second year. The expected net cash flows from this project are summarized in Table.

In normal situations, TIP would not even consider a marginal project such as this one. However, hoping that the company can establish itself as a technology leader in the field, management felt that it was worth outbidding its competitors. Financially, what is the economic worth of outbidding the competitors for this project

(a) Determine whether this project is or is not a mixed investment.

(b) Compute the IRR for this investment. Assume MARR = 12%.

(c) Should Boeing accept the project

TABLE 21

In normal situations, TIP would not even consider a marginal project such as this one. However, hoping that the company can establish itself as a technology leader in the field, management felt that it was worth outbidding its competitors. Financially, what is the economic worth of outbidding the competitors for this project

(a) Determine whether this project is or is not a mixed investment.

(b) Compute the IRR for this investment. Assume MARR = 12%.

(c) Should Boeing accept the project

TABLE 21

التوضيح

The seventh chapter of the textbook focu...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255