Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 23

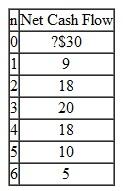

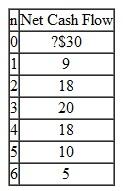

Recent technology has made possible a computerized vending machine that can grind coffee beans and brew fresh coffee on demand. The computer also makes possible such complicated functions as changing $5 and $10 bills, tracking the age of an item, and moving the oldest stock to the front of the line, thus cutting down on spoilage. With a price tag of $4,500 for each unit, Easy Snack has estimated the cash flows in millions of dollars over the product's six-year useful life, including the initial investment, as given in Table.

(a) On the basis of the IRR criterion, if the firm's MARR is 18%, is this product worth marketing

(b) If the required investment remains unchanged, but the future cash flows are expected to be 10%

TABLE 36

higher than the original estimates, how much of an increase in IRR do you expect

higher than the original estimates, how much of an increase in IRR do you expect

(c) If the required investment has increased from $30 million to $35 million, but the expected future cash flows are projected to be 10% smaller than the original estimates, how much of a decrease in IRR do you expect

(a) On the basis of the IRR criterion, if the firm's MARR is 18%, is this product worth marketing

(b) If the required investment remains unchanged, but the future cash flows are expected to be 10%

TABLE 36

higher than the original estimates, how much of an increase in IRR do you expect

higher than the original estimates, how much of an increase in IRR do you expect (c) If the required investment has increased from $30 million to $35 million, but the expected future cash flows are projected to be 10% smaller than the original estimates, how much of a decrease in IRR do you expect

التوضيح

The problem relates to the cash flow ser...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255