Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 3

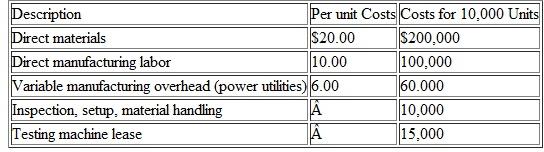

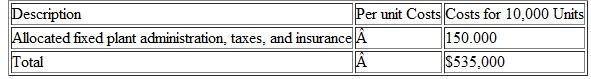

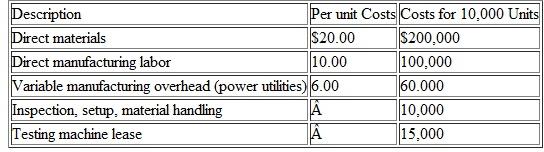

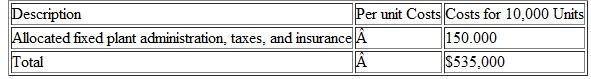

K Mfg. Company produces golf carts. The company expects to sell 10,000 units yearly. Currently the company produces the engines to power the golf carts. To produce the 10,000 engines. J.K needs to budget the following amount for the current fiscal year:

J.K has received an offer from an outside vendor to supply any number of engines to go with the golf carts. The outside vendor quotes $40 per engine. The following additional information is available

• Inspection, setup, and material handling costs vary with the number of batches in which the engines are produced. J.K produces engines in batch sizes of 1,000 units. J.K estimates that it will produce the 10,000 units in 10 batches.

• J K rents a special testing machine for $15 000 a year to produce the engines in-house. If J.K buys all its engines from the outside vendor, it does not need this testing machine.

(a) Assume that if J.K purchases the engines from the outside supplier, the facility where the engines are currently made will remain idle. Should J.K accept the outside supplier's offer at the anticipated production (and sales) volume of 10,000 units

(b) If the engines are purchased outside, the facilities where the engines are currently made will be used to upgrade the golf carts by adding GPS monitors to display the accurate distance information to the players. As a consequence, the selling price on golf carts will be raised by $100. The variable per unit cost of the upgrade would be $90, and additional tooling costs of $80,000 would be incurred. Should J.K make or buy the engines, assuming that 10.000 units are produced (and sold)

(c) The sales manager at J.K is concerned that the estimate of 10,000 units may be too optimistic and believes that only 6,000 units would be sold. At this lower estimate, J.K will produce the engines in 8 batches of 750 units each. Then, the inspection, setup, and material handling costs will be reduced to $6,000. Should J.K purchase the engines from the outside vendor

Table

J.K has received an offer from an outside vendor to supply any number of engines to go with the golf carts. The outside vendor quotes $40 per engine. The following additional information is available

• Inspection, setup, and material handling costs vary with the number of batches in which the engines are produced. J.K produces engines in batch sizes of 1,000 units. J.K estimates that it will produce the 10,000 units in 10 batches.

• J K rents a special testing machine for $15 000 a year to produce the engines in-house. If J.K buys all its engines from the outside vendor, it does not need this testing machine.

(a) Assume that if J.K purchases the engines from the outside supplier, the facility where the engines are currently made will remain idle. Should J.K accept the outside supplier's offer at the anticipated production (and sales) volume of 10,000 units

(b) If the engines are purchased outside, the facilities where the engines are currently made will be used to upgrade the golf carts by adding GPS monitors to display the accurate distance information to the players. As a consequence, the selling price on golf carts will be raised by $100. The variable per unit cost of the upgrade would be $90, and additional tooling costs of $80,000 would be incurred. Should J.K make or buy the engines, assuming that 10.000 units are produced (and sold)

(c) The sales manager at J.K is concerned that the estimate of 10,000 units may be too optimistic and believes that only 6,000 units would be sold. At this lower estimate, J.K will produce the engines in 8 batches of 750 units each. Then, the inspection, setup, and material handling costs will be reduced to $6,000. Should J.K purchase the engines from the outside vendor

Table

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255