Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 8

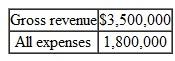

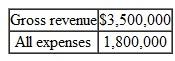

Consider a corporation whose taxable income without state income tax is

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.التوضيح

It is given that the marginal tax rate i...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255