Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 1

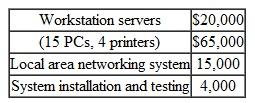

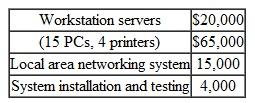

A small children's clothing manufacturer is considering an investment to computerize its management information system for material requirement planning, piece-goods coupon printing, and invoice and payroll services. An outside consultant has been retained to estimate the initial hardware requirement and installation costs. He suggests the following:

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year property under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system are expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year property under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system are expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year property under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system are expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year property under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system are expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.التوضيح

The way this problem should be answered ...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255