Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 16

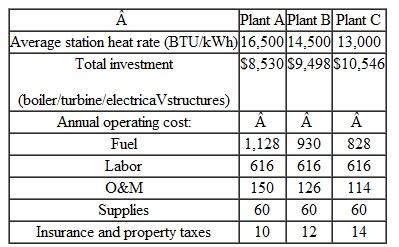

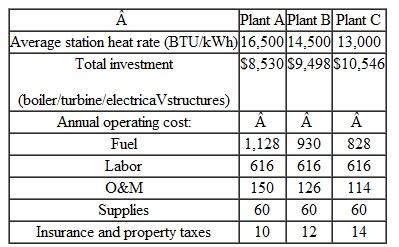

An international manufacturer of prepared food items needs 50,000,000 kWh of electrical energy a year, with a maximum demand of 10,000 kW. The local utility company currently charges $0.085 per kWh-a rate considered high throughout the industry. Because the firm's power consumption is so large, its engineers are considering installing a 10,000-kW steam-turbine plant. Three types of plant have been proposed (units in thousands of dollars) and are given in Table.

The service life of each plant is expected to be 20 years. The plant investment will be subject to a

TABLE 29

20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of its original investment. The firm's MARR is known to be 12%. The firm's marginal income tax rate is 39%.

20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of its original investment. The firm's MARR is known to be 12%. The firm's marginal income tax rate is 39%.

(a) Determine the unit power cost ($/kWh) for each plant.

(b) Which plant would provide the most economical power

The service life of each plant is expected to be 20 years. The plant investment will be subject to a

TABLE 29

20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of its original investment. The firm's MARR is known to be 12%. The firm's marginal income tax rate is 39%.

20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of its original investment. The firm's MARR is known to be 12%. The firm's marginal income tax rate is 39%.(a) Determine the unit power cost ($/kWh) for each plant.

(b) Which plant would provide the most economical power

التوضيح

The given information is as follows:

50,...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255