Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 25

Consider the following lease-versus-borrow-and-purchase problem.

• Borrow-and-purchase option:

1. Jensen Manufacturing Company plans to acquire sets of special industrial tools with a four-year life and a cost of $200,000- delivered and installed. The tools will be depreciated by the MACRS three-year classification.

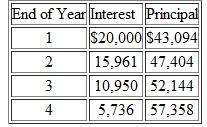

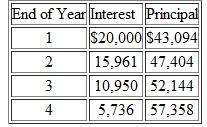

2. Jensen can borrow the required $200,000 at a rate of 10% over four years. Four equal end-of-year annual payments would be made in the amount of $63,094 = $200,000( A/P , 10%, 4). The annual interest and principal payment schedule, along with the equivalent present worth of these payments, is

3. The estimated salvage value for the tool sets at the end of four years is $20,000.

3. The estimated salvage value for the tool sets at the end of four years is $20,000.

4. If Jensen borrows and buys, it will have to bear the cost of maintenance, which will be performed by the tool manufacturer at a fixed contract rate of $10,000 per year.

• Lease option:

1. Jensen can lease the tools for four years at an annual rental charge of $70,000 - payable at the end of each year.

2. The lease contract specifies that the lessor will maintain the tools at no additional charge to Jensen.

Jensen's lax rate is 40%. Any gains will also be taxed at 40%.

(a) What is Jensen's PW of after-tax cash flow of leasing at i = 15%

(b) What is Jensen's PW of after-tax cash flow of owning at i = 15%

• Borrow-and-purchase option:

1. Jensen Manufacturing Company plans to acquire sets of special industrial tools with a four-year life and a cost of $200,000- delivered and installed. The tools will be depreciated by the MACRS three-year classification.

2. Jensen can borrow the required $200,000 at a rate of 10% over four years. Four equal end-of-year annual payments would be made in the amount of $63,094 = $200,000( A/P , 10%, 4). The annual interest and principal payment schedule, along with the equivalent present worth of these payments, is

3. The estimated salvage value for the tool sets at the end of four years is $20,000.

3. The estimated salvage value for the tool sets at the end of four years is $20,000.4. If Jensen borrows and buys, it will have to bear the cost of maintenance, which will be performed by the tool manufacturer at a fixed contract rate of $10,000 per year.

• Lease option:

1. Jensen can lease the tools for four years at an annual rental charge of $70,000 - payable at the end of each year.

2. The lease contract specifies that the lessor will maintain the tools at no additional charge to Jensen.

Jensen's lax rate is 40%. Any gains will also be taxed at 40%.

(a) What is Jensen's PW of after-tax cash flow of leasing at i = 15%

(b) What is Jensen's PW of after-tax cash flow of owning at i = 15%

التوضيح

Options of Buy or borrow and lease: The ...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255