Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 21

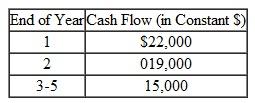

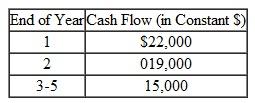

The Norcross Fiber Company is considering automating its piece-goods screen-printing system at a cost of $20,000. The firm expects to phase out the new printing system at the end of five years due to changes in style. At that time, the firm could scrap the system for $2,000 in today's dollars. The expected net savings due to automation also are in today's dollars (constant dollars):

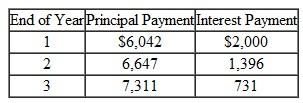

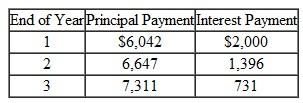

The system qualifies as a five-year MACRS property and will be depreciated accordingly. The expected average general inflation rate over the next five years is approximately 5% per year. The firm will finance the entire project by borrowing at 10%. The scheduled repayment of the loan will be:

The system qualifies as a five-year MACRS property and will be depreciated accordingly. The expected average general inflation rate over the next five years is approximately 5% per year. The firm will finance the entire project by borrowing at 10%. The scheduled repayment of the loan will be:

The firm's market interest rate for project evaluation during this inflation-ridden time is 20%. Assume that the net savings and the selling price will be responsive to this average inflation rate. The firm's marginal tax rate is known to be 40%.

The firm's market interest rate for project evaluation during this inflation-ridden time is 20%. Assume that the net savings and the selling price will be responsive to this average inflation rate. The firm's marginal tax rate is known to be 40%.

(a) Determine the after-tax cash flows of this project in actual dollars.

(b) Determine the net present-value reduction (or gains) in profitability due to inflation.

The system qualifies as a five-year MACRS property and will be depreciated accordingly. The expected average general inflation rate over the next five years is approximately 5% per year. The firm will finance the entire project by borrowing at 10%. The scheduled repayment of the loan will be:

The system qualifies as a five-year MACRS property and will be depreciated accordingly. The expected average general inflation rate over the next five years is approximately 5% per year. The firm will finance the entire project by borrowing at 10%. The scheduled repayment of the loan will be: The firm's market interest rate for project evaluation during this inflation-ridden time is 20%. Assume that the net savings and the selling price will be responsive to this average inflation rate. The firm's marginal tax rate is known to be 40%.

The firm's market interest rate for project evaluation during this inflation-ridden time is 20%. Assume that the net savings and the selling price will be responsive to this average inflation rate. The firm's marginal tax rate is known to be 40%.(a) Determine the after-tax cash flows of this project in actual dollars.

(b) Determine the net present-value reduction (or gains) in profitability due to inflation.

التوضيح

The eleventh chapter of the textbook foc...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255