Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 27

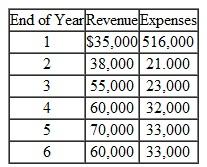

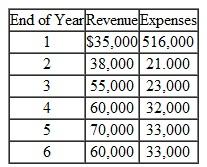

Sonja Jensen is considering the purchase of a fast-food franchise. Sonja will be operating on a lot that is to be converted into a parking lot in six years, but that may be rented in the interim for $800 per month. The franchise and necessary equipment will have a total initial cost of $55,000 and a salvage value of $10,000 (in today's dollars) after six years. Sonja is told that the future annual general inflation rate will be 5%. The projected operating revenues and expenses (in actual dollars) other than rent and depreciation for the business are

Assume that the initial investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 10% in other investment activities during this inflation-ridden period.

Assume that the initial investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 10% in other investment activities during this inflation-ridden period.

(a) Determine the cash flows associated with the investment over its life.

(b) Compute the projected after-tax rate of return (real or inflation-free) for this investment opportunity and justify whether or not it is worth undertaking.

Assume that the initial investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 10% in other investment activities during this inflation-ridden period.

Assume that the initial investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 10% in other investment activities during this inflation-ridden period.(a) Determine the cash flows associated with the investment over its life.

(b) Compute the projected after-tax rate of return (real or inflation-free) for this investment opportunity and justify whether or not it is worth undertaking.

التوضيح

The eleventh chapter of the textbook foc...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255