Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 28

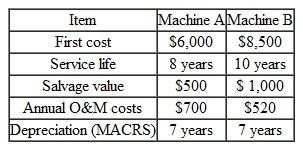

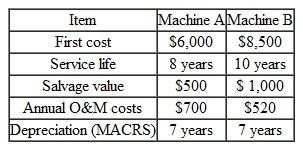

A small manufacturing firm is considering purchasing a new boring machine to modernize one of its production lines. Two types of boring machines are available on the market. The lives of machine A and machine B are eight years and 10 years, respectively. The machines have the following receipts and disbursements:

Use a MARR (after tax) of 10% and a marginal tax rate of 30%, and answer the following questions.

(a) Which machine would be most economical to purchase under an infinite planning horizon Explain any assumption that you need to make about future alternatives.

(b) Determine the break-even annual O M costs for machine A so that the annual equivalent cost of machine A is the same as that of machine B.

(c) Suppose that the required service life of the machine is only five years. The salvage values at the end of the required service period are estimated to be $3,000 for machine A and $3,500 for machine B. Which machine is more economical

(c) Suppose that the required service life of the machine is only five years. The salvage values at the end of the required service period are estimated to be $3,000 for machine A and $3,500 for machine B. Which machine is more economical

Use a MARR (after tax) of 10% and a marginal tax rate of 30%, and answer the following questions.

(a) Which machine would be most economical to purchase under an infinite planning horizon Explain any assumption that you need to make about future alternatives.

(b) Determine the break-even annual O M costs for machine A so that the annual equivalent cost of machine A is the same as that of machine B.

(c) Suppose that the required service life of the machine is only five years. The salvage values at the end of the required service period are estimated to be $3,000 for machine A and $3,500 for machine B. Which machine is more economical

(c) Suppose that the required service life of the machine is only five years. The salvage values at the end of the required service period are estimated to be $3,000 for machine A and $3,500 for machine B. Which machine is more economicalالتوضيح

The twelfth chapter in the textbook asks...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255