Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 30

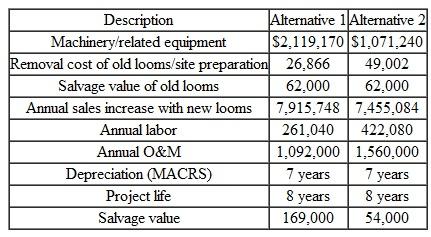

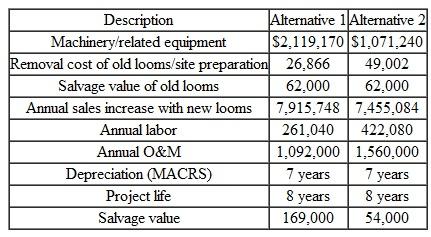

The management of Langdale Mill is considering replacing a number of old looms in the mill's weave room. The looms to be replaced are two 86-inch President looms, sixteen 54-inch President looms, and twenty-two 72-inch Draper X-P2 looms. The company may either replace the old looms with new ones of the same kind or buy 21 new shutterless Pignone looms (Table). The first alternative requires purchasing 40 new President and Draper looms and scrapping the old looms. The second alternative involves scrapping the 40 old looms, relocating 12 Picanol looms, and constructing a concrete floor, plus purchasing the 21 Pignone looms and various related equipment.

The firm's MARR is 18%, set by corporate executives who feel that various investment opportunities available for the mills will guarantee a rate of return on investment of at least 18%. The mill's marginal tax rate is 40%.

(a) Perform a sensitivity analysis on the project's data, varying the operating revenue, labor cost, annual O M cost, and MARR. Assume that each of these variables can deviate from its base-case expected value by ±10%, by ±20%, and by ±30%.

(b) From the results of part (a), prepare sensitivity diagrams and interpret the results.

TABLE 8

The firm's MARR is 18%, set by corporate executives who feel that various investment opportunities available for the mills will guarantee a rate of return on investment of at least 18%. The mill's marginal tax rate is 40%.

(a) Perform a sensitivity analysis on the project's data, varying the operating revenue, labor cost, annual O M cost, and MARR. Assume that each of these variables can deviate from its base-case expected value by ±10%, by ±20%, and by ±30%.

(b) From the results of part (a), prepare sensitivity diagrams and interpret the results.

TABLE 8

التوضيح

The twelfth chapter in the textbook asks...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255