Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 17

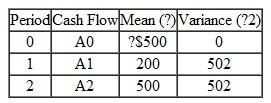

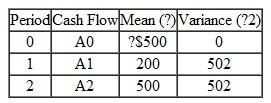

Consider the following investment cash flows over a two-year life:

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if

1. A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.3

(b) In part (a)-(1), if random variables ( A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be negative. (See Appendix B.)

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if1. A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.3

(b) In part (a)-(1), if random variables ( A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be negative. (See Appendix B.)

التوضيح

The twelfth chapter in the textbook asks...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255