Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 19

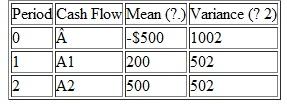

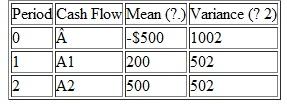

Consider the following investment cash flows over a 2-year life:

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if

1. A 0 , A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.5, but 01 = 02 = 0.2

3. A 0 , A 1 , and A 2 are perfectly positively correlated.

(b) In part (a)( 1), if random variables ( A 0 , A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be greater than $100.

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if1. A 0 , A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.5, but 01 = 02 = 0.2

3. A 0 , A 1 , and A 2 are perfectly positively correlated.

(b) In part (a)( 1), if random variables ( A 0 , A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be greater than $100.

التوضيح

The expected value in terms of the proba...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255