Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 23

The Kellogg Company is considering the following investment project and has estimated all cost and revenues in constant dollars. The project requires the purchase of a $9,000 asset, which will be used for only two years (the project life).

• The salvage value of this asset at the end of two years is expected to be $4,000.

• The project requires an investment of $2,000 in working capital, and this amount will be fully recovered at the end of the project year.

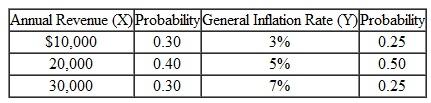

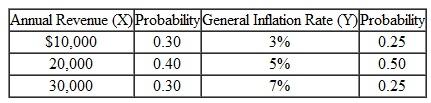

• The annual revenue, as well as general inflation, are discrete random variables but can be described by the probability distributions in Table (both random variables are statistically independent).

• The investment will be classified as a three-year MACRS property (tax life).

• It is assumed that the revenues, salvage value, and working capital are responsive to the general inflation rate.

• The revenue and inflation rate dictated during the first year will prevail over the remainder of the project period.

• The marginal income tax rate for the firm is 40%. The firm's inflation-free interest rate ( i ) is 10%.

(a) Determine the NPW as a function of X and Y.

(b) In part (a), compute the expected NPW of this investment.

(c) In part (a), compute the variance of the NPW of the investment.

TABLE 20

• The salvage value of this asset at the end of two years is expected to be $4,000.

• The project requires an investment of $2,000 in working capital, and this amount will be fully recovered at the end of the project year.

• The annual revenue, as well as general inflation, are discrete random variables but can be described by the probability distributions in Table (both random variables are statistically independent).

• The investment will be classified as a three-year MACRS property (tax life).

• It is assumed that the revenues, salvage value, and working capital are responsive to the general inflation rate.

• The revenue and inflation rate dictated during the first year will prevail over the remainder of the project period.

• The marginal income tax rate for the firm is 40%. The firm's inflation-free interest rate ( i ) is 10%.

(a) Determine the NPW as a function of X and Y.

(b) In part (a), compute the expected NPW of this investment.

(c) In part (a), compute the variance of the NPW of the investment.

TABLE 20

التوضيح

The twelfth chapter in the textbook asks...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255