Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 13

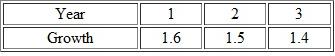

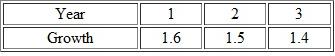

You are considering an investment in a Christmas tree farm over three years. The farm already has trees planted a year ago, and these trees grow each year by the following factors.

The price of the trees follows a binomial lattice with it u = 1.25 and d = 0.80. As the trees grow older, the value of the investment in general will increase. However, if the trees get too big, they are less attractive, so a three-year rotation appears to be a typical lifecycle for this type of Christmas tree. The interest rate (risk-free) is constant at continuous 6%. It costs $400,000 each year-payable at the beginning of the year-to lease the forestland. The initial value of the one-year old trees is $1 million (assuming they were harvested immediately) You can cut the trees at the beginning of the Christmas season (say, December 1) of any year and then nor pay rent after that.

The price of the trees follows a binomial lattice with it u = 1.25 and d = 0.80. As the trees grow older, the value of the investment in general will increase. However, if the trees get too big, they are less attractive, so a three-year rotation appears to be a typical lifecycle for this type of Christmas tree. The interest rate (risk-free) is constant at continuous 6%. It costs $400,000 each year-payable at the beginning of the year-to lease the forestland. The initial value of the one-year old trees is $1 million (assuming they were harvested immediately) You can cut the trees at the beginning of the Christmas season (say, December 1) of any year and then nor pay rent after that.

(a) It costs $400,000 each year, payable at the beginning of the year, to lease the forest land. You can cut the trees at the beginning of Christmas season (Say, December 1) of any year and then not pay rent after that. Find the best cutting policy with this rent.

(b) Suppose there is no rent. Find the best cutting policy without rent.

The price of the trees follows a binomial lattice with it u = 1.25 and d = 0.80. As the trees grow older, the value of the investment in general will increase. However, if the trees get too big, they are less attractive, so a three-year rotation appears to be a typical lifecycle for this type of Christmas tree. The interest rate (risk-free) is constant at continuous 6%. It costs $400,000 each year-payable at the beginning of the year-to lease the forestland. The initial value of the one-year old trees is $1 million (assuming they were harvested immediately) You can cut the trees at the beginning of the Christmas season (say, December 1) of any year and then nor pay rent after that.

The price of the trees follows a binomial lattice with it u = 1.25 and d = 0.80. As the trees grow older, the value of the investment in general will increase. However, if the trees get too big, they are less attractive, so a three-year rotation appears to be a typical lifecycle for this type of Christmas tree. The interest rate (risk-free) is constant at continuous 6%. It costs $400,000 each year-payable at the beginning of the year-to lease the forestland. The initial value of the one-year old trees is $1 million (assuming they were harvested immediately) You can cut the trees at the beginning of the Christmas season (say, December 1) of any year and then nor pay rent after that.(a) It costs $400,000 each year, payable at the beginning of the year, to lease the forest land. You can cut the trees at the beginning of Christmas season (Say, December 1) of any year and then not pay rent after that. Find the best cutting policy with this rent.

(b) Suppose there is no rent. Find the best cutting policy without rent.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255