Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 19

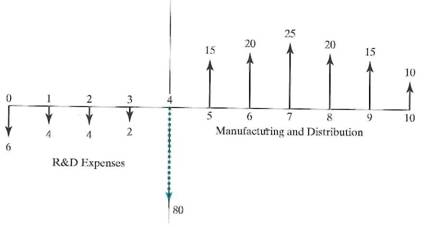

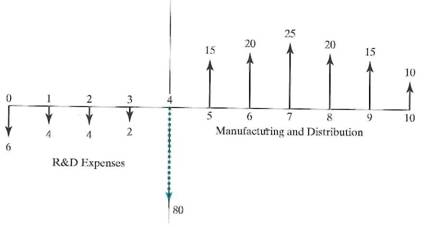

A pharmaceutical company needs to estimate the maximum amount to spend on R D for a new type of diet drug. It is estimated that three years of R D spending will be required to develop and test market the drug. After the initial three years, an investment in manufacturing and production will be required in year 4. It is estimated today that net cash inflows for six years will be received from sales of the drug. Figure is a cash flow diagram summarizing the firm's estimates.

Assuming a MARR of 12%, a = 50%, and a risk-free interest rate of 6%, determine whether or not the required spending on R D for this diet drug can be justified.

Figure P13.19

Assuming a MARR of 12%, a = 50%, and a risk-free interest rate of 6%, determine whether or not the required spending on R D for this diet drug can be justified.

Figure P13.19

التوضيح

The thirteenth chapter in the textbook a...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255