Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 13

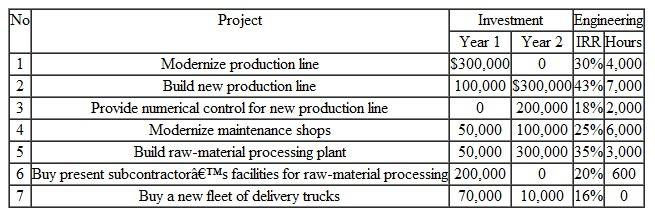

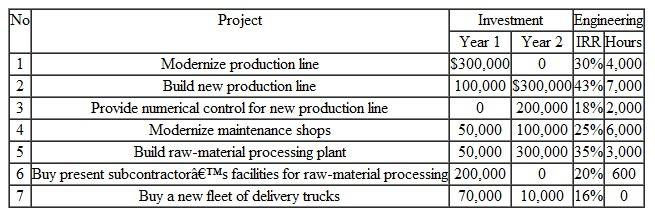

The National Food Processing Company is considering investing in plant modernization and plant expansion. These proposed projects would be completed in two years, with varying requirements of money and plant engineering. Management is willing to use the somewhat uncertain data in Table in selecting the best set of proposals. The resource limitations are as follows:

• First-year expenditures: $450,000

• Second-year expenditures: $420,000

• Engineering hours: 11,000 hours

The situation requires that a new or modernized production line be provided (project 1 or project 2 which are mutually exclusive). The numerical control (project 3) is applicable only to the new line. The company obviously does not want to both buy (project 6) and build (project 5) raw-material processing facilities; it can, if desirable, rely on the present supplier as an independent firm. Neither the maintenance-shop project (project 4) nor the delivery-truck purchase (project 7) is mandatory.

(a) Enumerate all possible mutually exclusive alternatives without considering the budget and engineering-hour constraints.

(b) Identify all feasible mutually exclusive alternatives.

(c) Suppose that the firm's marginal cost of capital will be 14% for raising the required capital up to $1 million. Which projects would be included in the firm's budget

TABLE ST 15.2

• First-year expenditures: $450,000

• Second-year expenditures: $420,000

• Engineering hours: 11,000 hours

The situation requires that a new or modernized production line be provided (project 1 or project 2 which are mutually exclusive). The numerical control (project 3) is applicable only to the new line. The company obviously does not want to both buy (project 6) and build (project 5) raw-material processing facilities; it can, if desirable, rely on the present supplier as an independent firm. Neither the maintenance-shop project (project 4) nor the delivery-truck purchase (project 7) is mandatory.

(a) Enumerate all possible mutually exclusive alternatives without considering the budget and engineering-hour constraints.

(b) Identify all feasible mutually exclusive alternatives.

(c) Suppose that the firm's marginal cost of capital will be 14% for raising the required capital up to $1 million. Which projects would be included in the firm's budget

TABLE ST 15.2

التوضيح

The fifteenth chapter that is in the tex...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255