Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 17

The Edison Power Company currently owns and operates a coal-fired combustion turbine plant that was installed 20 years ago. Because of degradation of the system, 65 forced outages occurred during the last year alone and two boiler explosions during the last seven years. Edison is planning to scrap the current plant and install a new, improved gas-turbine plant that produces more energy per unit of fuel than typical coal-fired boilers produce.

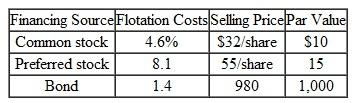

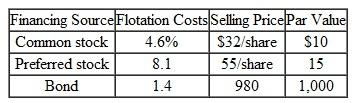

The new 50-MW gas-turbine plant, which runs on gasified coal, wood, or agricultural wastes, will cost Edison $65 million. Edison wants to raise the capital from three financing sources: 45% common stock, 10% preferred stock (which carries a 6% cash dividend when declared), and 45% borrowed funds. Edison's investment banks quote the following flotation costs:

(a) What are the total flotation costs to raise $65 million

(a) What are the total flotation costs to raise $65 million

(b) How many shares (both common and preferred) or bonds must be sold to raise $65 million

(c) If Edison makes annual cash dividends of $2 per common share and annual bond interest

payments are at the rate of 12%, how much cash should Edison have available to meet both the equity and debt obligation (Note that whenever a firm declares cash dividends to its common stockholders, the preferred stockholders are entitled to receive dividends of 6% of par value.)

The new 50-MW gas-turbine plant, which runs on gasified coal, wood, or agricultural wastes, will cost Edison $65 million. Edison wants to raise the capital from three financing sources: 45% common stock, 10% preferred stock (which carries a 6% cash dividend when declared), and 45% borrowed funds. Edison's investment banks quote the following flotation costs:

(a) What are the total flotation costs to raise $65 million

(a) What are the total flotation costs to raise $65 million (b) How many shares (both common and preferred) or bonds must be sold to raise $65 million

(c) If Edison makes annual cash dividends of $2 per common share and annual bond interest

payments are at the rate of 12%, how much cash should Edison have available to meet both the equity and debt obligation (Note that whenever a firm declares cash dividends to its common stockholders, the preferred stockholders are entitled to receive dividends of 6% of par value.)

التوضيح

The fifteenth chapter that is in the tex...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255