Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

النسخة 6الرقم المعياري الدولي: 978-0134105598 تمرين 6

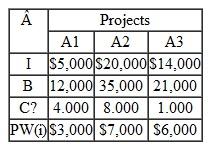

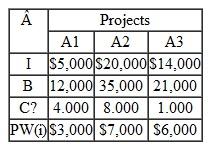

Consider three investment projects, A1, A2, and A3. Each project has the same service life, and the present worth of each component value (B, I, and C ) is computed at 10% as follows:

TABLE 8

(a) If all three projects are independent, which projects would be selected based on BC ( i )

(a) If all three projects are independent, which projects would be selected based on BC ( i )

(b) If the three projects are mutually exclusive, which project would be the best alternative Show the sequence of calculations that would be required to produce the correct results. Use the B/C ratio on incremental investment.

TABLE 8

(a) If all three projects are independent, which projects would be selected based on BC ( i )

(a) If all three projects are independent, which projects would be selected based on BC ( i ) (b) If the three projects are mutually exclusive, which project would be the best alternative Show the sequence of calculations that would be required to produce the correct results. Use the B/C ratio on incremental investment.

التوضيح

The sixteenth chapter that is in the tex...

Contemporary Engineering Economics 6th Edition by Chan Park

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255