Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 27

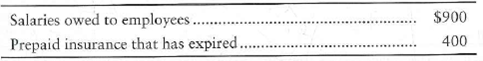

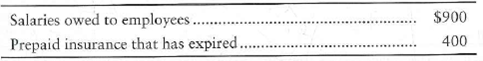

The net income of Steinbach Sons, a department store, decreased sharply during 2014. Mort Steinbach, manager of the store, anticipates the need for a bank loan in 2015. Late in 2014, Steinbach instructs the store's accountant to record a $2,000 sale of furniture to the Steinbach family, even though the goods will not be shipped from the manufacturer until January 2015. Steinbach also tells the accountant not to make the following December 31, 2014, adjusting entries:

Requirements

1. Compute the overall effects of these transactions on the store's reported income for 2014.

2. Why is Steinbach taking this action Is his action ethical Give your reason, identifying the parties helped and the parties harmed by Steinbach's action. (Challenge)

3. As a personal friend, what advice would you give the accountant (Challenge)

Requirements

1. Compute the overall effects of these transactions on the store's reported income for 2014.

2. Why is Steinbach taking this action Is his action ethical Give your reason, identifying the parties helped and the parties harmed by Steinbach's action. (Challenge)

3. As a personal friend, what advice would you give the accountant (Challenge)

التوضيح

These transactions-recorded as directed ...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255