Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 50

Applying the lower-of-cost-or-market rule to inventories

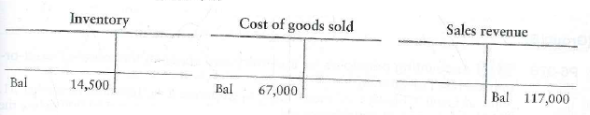

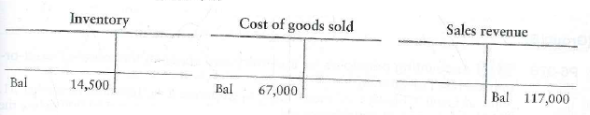

Richmond Sporting Goods, which uses the FIFO method, has the following account balances at August 31, 2012, prior to releasing the financial statements for the year:

Richmond has determined that the replacement cost (current market value) of the August 31, 2012, ending inventory is $13,500.

Requirements

1. Prepare any adjusting journal entry required from the information given.

2. What value would Richmond report on the balance sheet at August 31, 2012, for inventory

Richmond Sporting Goods, which uses the FIFO method, has the following account balances at August 31, 2012, prior to releasing the financial statements for the year:

Richmond has determined that the replacement cost (current market value) of the August 31, 2012, ending inventory is $13,500.

Requirements

1. Prepare any adjusting journal entry required from the information given.

2. What value would Richmond report on the balance sheet at August 31, 2012, for inventory

التوضيح

1. This exercise requires application of...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255