Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 7

Preparing a bank reconciliation and journal entries

The August 31 bank statement of Winchester's Healthcare has just arrived from United Bank. To prepare the bank reconciliation, you gather the following data:

a. The August 31 bank balance is $4,870.

b. The bank statement includes two charges for NSF checks from customers. One is for $400 (#1), and the other for $110 (#2).

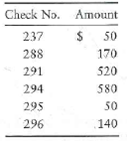

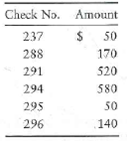

c. The following Winchester checks are outstanding at August 31:

d. Winchester collects from a few customers by EFT. The August bank statement lists a $1,300 EFT deposit for a collection on account.

e. The bank statement includes two special deposits that Winchester hasn't recorded yet: $970, for dividend revenue, and $80, the interest revenue Winchester earned on its bank balance during August.

d. The bank statement lists a $30 subtraction for the bank service charge.

g. On August 31, the Winchester treasurer deposited $350, but this deposit does not appear on the bank statement.

h. The bank statement includes a $1,000 deduction for a check drawn by Multi-State Freight Company. Winchester notified the bank of this bank error.

i. Winchester's Cash account shows a balance of $2,900 on August. 31.

Requirements

1. Prepare the bank reconciliation for Winchester's Healthcare at August 31, 2012.

2. Journalize any required entries from the bank reconciliation. Include an explanation for each entry.

The August 31 bank statement of Winchester's Healthcare has just arrived from United Bank. To prepare the bank reconciliation, you gather the following data:

a. The August 31 bank balance is $4,870.

b. The bank statement includes two charges for NSF checks from customers. One is for $400 (#1), and the other for $110 (#2).

c. The following Winchester checks are outstanding at August 31:

d. Winchester collects from a few customers by EFT. The August bank statement lists a $1,300 EFT deposit for a collection on account.

e. The bank statement includes two special deposits that Winchester hasn't recorded yet: $970, for dividend revenue, and $80, the interest revenue Winchester earned on its bank balance during August.

d. The bank statement lists a $30 subtraction for the bank service charge.

g. On August 31, the Winchester treasurer deposited $350, but this deposit does not appear on the bank statement.

h. The bank statement includes a $1,000 deduction for a check drawn by Multi-State Freight Company. Winchester notified the bank of this bank error.

i. Winchester's Cash account shows a balance of $2,900 on August. 31.

Requirements

1. Prepare the bank reconciliation for Winchester's Healthcare at August 31, 2012.

2. Journalize any required entries from the bank reconciliation. Include an explanation for each entry.

التوضيح

Journalizing is the chronological accoun...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255