Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 28

Preparing a bank reconciliation and journal entries

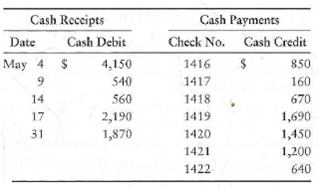

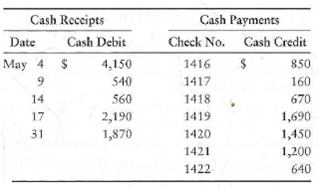

The May cash records of Dickson Insurance follow:

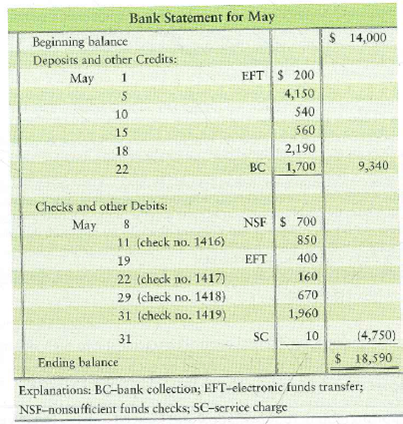

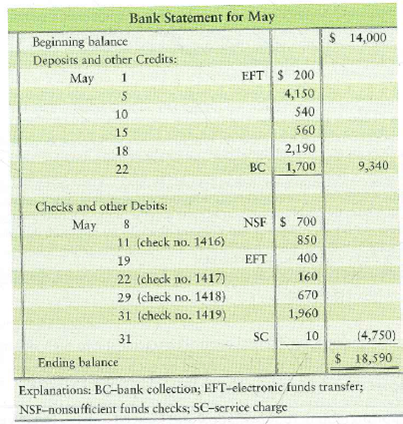

Dickson's Cash account shows a balance of $16,650 at May 31. On May 31, Dickson received the following bank statement:

Additional data for the bank reconciliation follow:

a. The EFT deposit was a receipt of rent. The EFT debit was an insurance payment.

b. The NSF check was received from a customer.

c. The $1,700 bank collection was for a note receivable.

d. The correct amount of check number 1419 for rent expense is $1,960. Dickson's controller mistakenly recorded the check for $1,690.

Requirements

1. Prepare the bank reconciliation of Dickson Insurance at May 31, 2012.

2. Journalize any required entries from the bank reconciliation.

The May cash records of Dickson Insurance follow:

Dickson's Cash account shows a balance of $16,650 at May 31. On May 31, Dickson received the following bank statement:

Additional data for the bank reconciliation follow:

a. The EFT deposit was a receipt of rent. The EFT debit was an insurance payment.

b. The NSF check was received from a customer.

c. The $1,700 bank collection was for a note receivable.

d. The correct amount of check number 1419 for rent expense is $1,960. Dickson's controller mistakenly recorded the check for $1,690.

Requirements

1. Prepare the bank reconciliation of Dickson Insurance at May 31, 2012.

2. Journalize any required entries from the bank reconciliation.

التوضيح

Journalizing is the chronological accoun...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255