Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 31

Preparing a bank reconciliation and journal entries

The October 31 bank statement of White's Healthcare has just arrived from State Bank. To prepare the bank reconciliation, you gather the following data:

a. The October 31 bank balance is $5,170.

b. The bank statement includes two charges for NSF checks from customers. One is for $420 (#1), and the other is for $120 (#2).

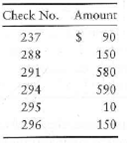

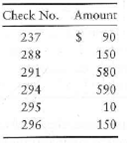

c. The following White checks are outstanding at October 31:

d. White collects from a few customers by EFT. The October bank statement lists a $1,400 EFT deposit for a collection on account.

e. The bank statement includes two special deposits that White hasn't recorded yet: $1,050, for dividend revenue, and $50, the interest revenue White earned on its bank balance during October.

f. The bank statement lists a $70 subtraction for the bank service charge.

g. On October 31, the White treasurer deposited $290, but this deposit does not appear on the bank statement.

h. The bank statement includes a $700 deduction for a check drawn by Multi-State Freight Company. White notified the bank of this bank error.

i. White's Cash account shows a balance of $2,700 on October 31.

Requirements

1. Prepare the bank reconciliation for White's Healthcare at October 3.1, 2012.

2. Journalize any required entries from the bank reconciliation. Include an explanation for each entry.

The October 31 bank statement of White's Healthcare has just arrived from State Bank. To prepare the bank reconciliation, you gather the following data:

a. The October 31 bank balance is $5,170.

b. The bank statement includes two charges for NSF checks from customers. One is for $420 (#1), and the other is for $120 (#2).

c. The following White checks are outstanding at October 31:

d. White collects from a few customers by EFT. The October bank statement lists a $1,400 EFT deposit for a collection on account.

e. The bank statement includes two special deposits that White hasn't recorded yet: $1,050, for dividend revenue, and $50, the interest revenue White earned on its bank balance during October.

f. The bank statement lists a $70 subtraction for the bank service charge.

g. On October 31, the White treasurer deposited $290, but this deposit does not appear on the bank statement.

h. The bank statement includes a $700 deduction for a check drawn by Multi-State Freight Company. White notified the bank of this bank error.

i. White's Cash account shows a balance of $2,700 on October 31.

Requirements

1. Prepare the bank reconciliation for White's Healthcare at October 3.1, 2012.

2. Journalize any required entries from the bank reconciliation. Include an explanation for each entry.

التوضيح

Journalizing is the chronological accoun...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255