Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 37

Preparing a corporate balance sheet, and measuring profitability

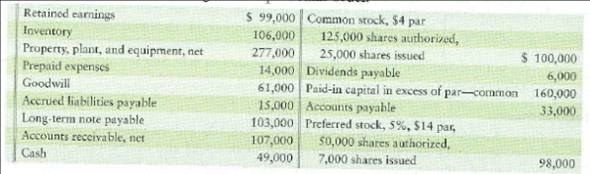

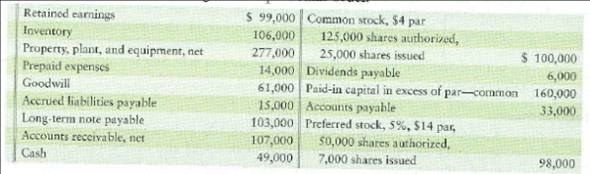

The following accounts and December 31, 2012, balances of Georgia Optical Corporation are arranged in no particular order.

Requirements

1. Prepare the company's classified balance sheet in account format at December 31, 2012.

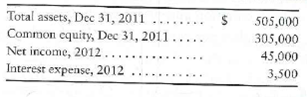

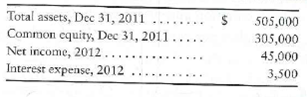

2. Compute Georgia Optical's rate of return on total assets and rate of return on common stockholders' equity for the year ended December 31, 2012.

3. Do these rates of return suggest strength or weakness Give your reasoning.

The following accounts and December 31, 2012, balances of Georgia Optical Corporation are arranged in no particular order.

Requirements

1. Prepare the company's classified balance sheet in account format at December 31, 2012.

2. Compute Georgia Optical's rate of return on total assets and rate of return on common stockholders' equity for the year ended December 31, 2012.

3. Do these rates of return suggest strength or weakness Give your reasoning.

التوضيح

This exercise requires application of th...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255