Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 41

Computing and recording a corporation's income tax

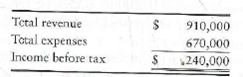

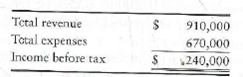

The accounting records of Reflection Glass Corporation provide income statement data for 2012.

Total expenses include depreciation of $54,000 computed on the straight-line method. In calculating taxable income on the tax return, Reflection Glass uses the modified accelerated cost recovery system (MACRS). MACRS depreciation was $75,000 for 2012. The corporate income tax rate is 36%.

Requirements

1. Compute taxable income for the year. For this computation, substitute MACRS depreciation in place of straight-line depreciation.

2. Journalize the corporation's income tax for 2012.

3. Show how to report the two income tax liabilities on Reflection's classified balance sheet.

The accounting records of Reflection Glass Corporation provide income statement data for 2012.

Total expenses include depreciation of $54,000 computed on the straight-line method. In calculating taxable income on the tax return, Reflection Glass uses the modified accelerated cost recovery system (MACRS). MACRS depreciation was $75,000 for 2012. The corporate income tax rate is 36%.

Requirements

1. Compute taxable income for the year. For this computation, substitute MACRS depreciation in place of straight-line depreciation.

2. Journalize the corporation's income tax for 2012.

3. Show how to report the two income tax liabilities on Reflection's classified balance sheet.

التوضيح

2.

Journalize the corporation...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255