Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

النسخة 3الرقم المعياري الدولي: 978-0132962339 تمرين 9

Using ratios to decide between two stock investments

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Best Digital, Corp., and Every Zone, Inc., and have assembled the following data.

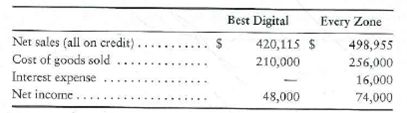

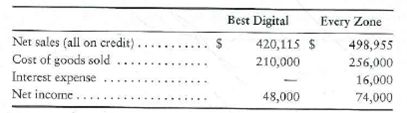

Selected income statement data for the current year:

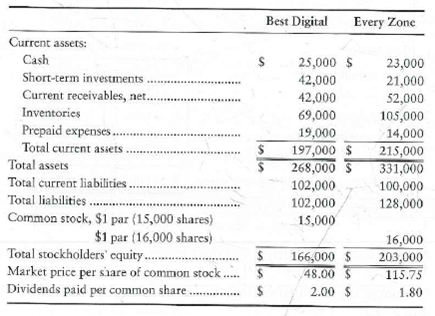

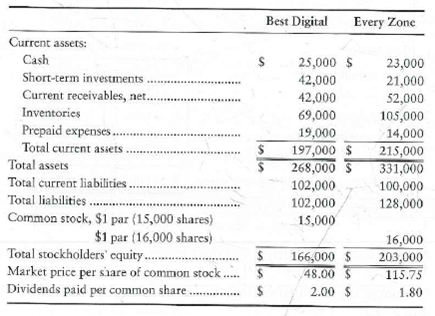

Selected balance sheet and market price data at the end of the current year:

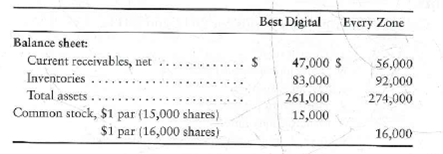

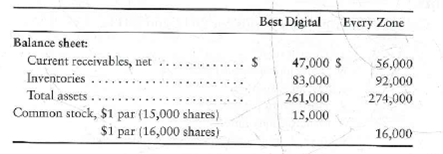

Selected balance sheet data at the beginning of the current year:

Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

Requirement

1. Compute the following ratios for both companies for the current year, and decide which company's stock better fits your investment strategy.

a. Acid-test ratio

b. Inventory turnover

c. Days'sales in receivables

d. Debt ratio

e. Earnings per share of common stock

f. Price/earnings ratio

g. Dividend payout

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Best Digital, Corp., and Every Zone, Inc., and have assembled the following data.

Selected income statement data for the current year:

Selected balance sheet and market price data at the end of the current year:

Selected balance sheet data at the beginning of the current year:

Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

Requirement

1. Compute the following ratios for both companies for the current year, and decide which company's stock better fits your investment strategy.

a. Acid-test ratio

b. Inventory turnover

c. Days'sales in receivables

d. Debt ratio

e. Earnings per share of common stock

f. Price/earnings ratio

g. Dividend payout

التوضيح

b.

We know that Best Digital's cost of g...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255