Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

النسخة 8الرقم المعياري الدولي: 978-1305585454

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

النسخة 8الرقم المعياري الدولي: 978-1305585454 تمرين 61

Barry Michaels earns $36,500 per year as the housewares manager at the Home Design Center.

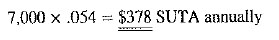

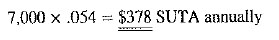

a. If the SUTA tax rate is 5.4% of the first $7,000 earned each year, how much SUTA tax must the company pay each year for Barry

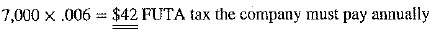

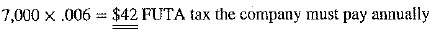

b. If the FUTA tax rate is 6.0% of the first $7,000 earned in a year minus the SUTA tax paid, how much FUTA tax must the company pay each year for Barry

a. If the SUTA tax rate is 5.4% of the first $7,000 earned each year, how much SUTA tax must the company pay each year for Barry

b. If the FUTA tax rate is 6.0% of the first $7,000 earned in a year minus the SUTA tax paid, how much FUTA tax must the company pay each year for Barry

التوضيح

Following information is given:

Gross e...

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255