Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

النسخة 8الرقم المعياري الدولي: 978-1305585454

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

النسخة 8الرقم المعياري الدولي: 978-1305585454 تمرين 36

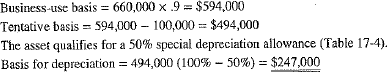

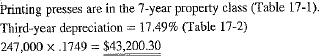

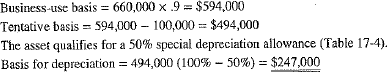

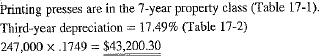

Ink Masters Printing purchased a new printing press for $660,000 on February 9, 2010. The press is used for business 90% of the time. As the accountant for the company, you elected to take a $100,000 Section 179 deduction. The press also qualified for a special depreciation allowance. (See Table 17-4.)

a. What was the basis for depreciation of the printing press

b. What was the amount of the third year's depreciation using MACRS

a. What was the basis for depreciation of the printing press

b. What was the amount of the third year's depreciation using MACRS

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255