M&B3 3rd Edition by Dean Croushore

النسخة 3الرقم المعياري الدولي: 978-1285167961

M&B3 3rd Edition by Dean Croushore

النسخة 3الرقم المعياري الدولي: 978-1285167961 تمرين 10

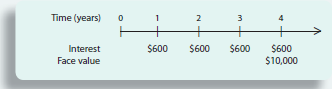

Suppose that you are considering the purchase of a security that has the following timeline of payments:

a How much would you be willing to pay for this security if the market interest rate is 6 percent

b Suppose that you have just purchased the security, and suddenly the market interest rate falls to 5 percent. What is the security worth

c Suppose that one year has elapsed, you have received the fi rst payment of $600, and the market interest rate is still 5 percent. How much would another investor be willing to pay for your security

d Suppose that two years have elapsed since you purchased the security, and you have received the fi rst two payments of $600 each. Now suppose that the market interest rate suddenly jumps to 10 percent. How much would another investor be willing to pay for your security

a How much would you be willing to pay for this security if the market interest rate is 6 percent

b Suppose that you have just purchased the security, and suddenly the market interest rate falls to 5 percent. What is the security worth

c Suppose that one year has elapsed, you have received the fi rst payment of $600, and the market interest rate is still 5 percent. How much would another investor be willing to pay for your security

d Suppose that two years have elapsed since you purchased the security, and you have received the fi rst two payments of $600 each. Now suppose that the market interest rate suddenly jumps to 10 percent. How much would another investor be willing to pay for your security

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

M&B3 3rd Edition by Dean Croushore

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255